Premiums, deductibles, copays — who knew that I would be learning so much about health insurance as a 20-year-old college student? For the last two weeks, I’ve been spending three days working at KCal Insurance Agency, my host office, which is located in Hacienda Heights. When initially coming in, I was quite nervous about what to expect; first of all, I had never been to Hacienda Heights and I was terrified to navigate the LA bus system, and second of all, I didn’t know much about the logistics behind health insurance. On my first day in office, I met my supervisor, Angela, who took me out to lunch. I was struck by how knowledgeable, kind, and confident she appeared as she talked about her journey — all the way from college, to business school, to working in New York, to finally coming back to California for KCal. I was surprised to learn that KCal was actually started by her father, Kenny, several decades ago, and has since expanded significantly.

In the office, I’ve been working with Angela’s assistant, Barbara, on various projects related to health disparities and healthcare access.

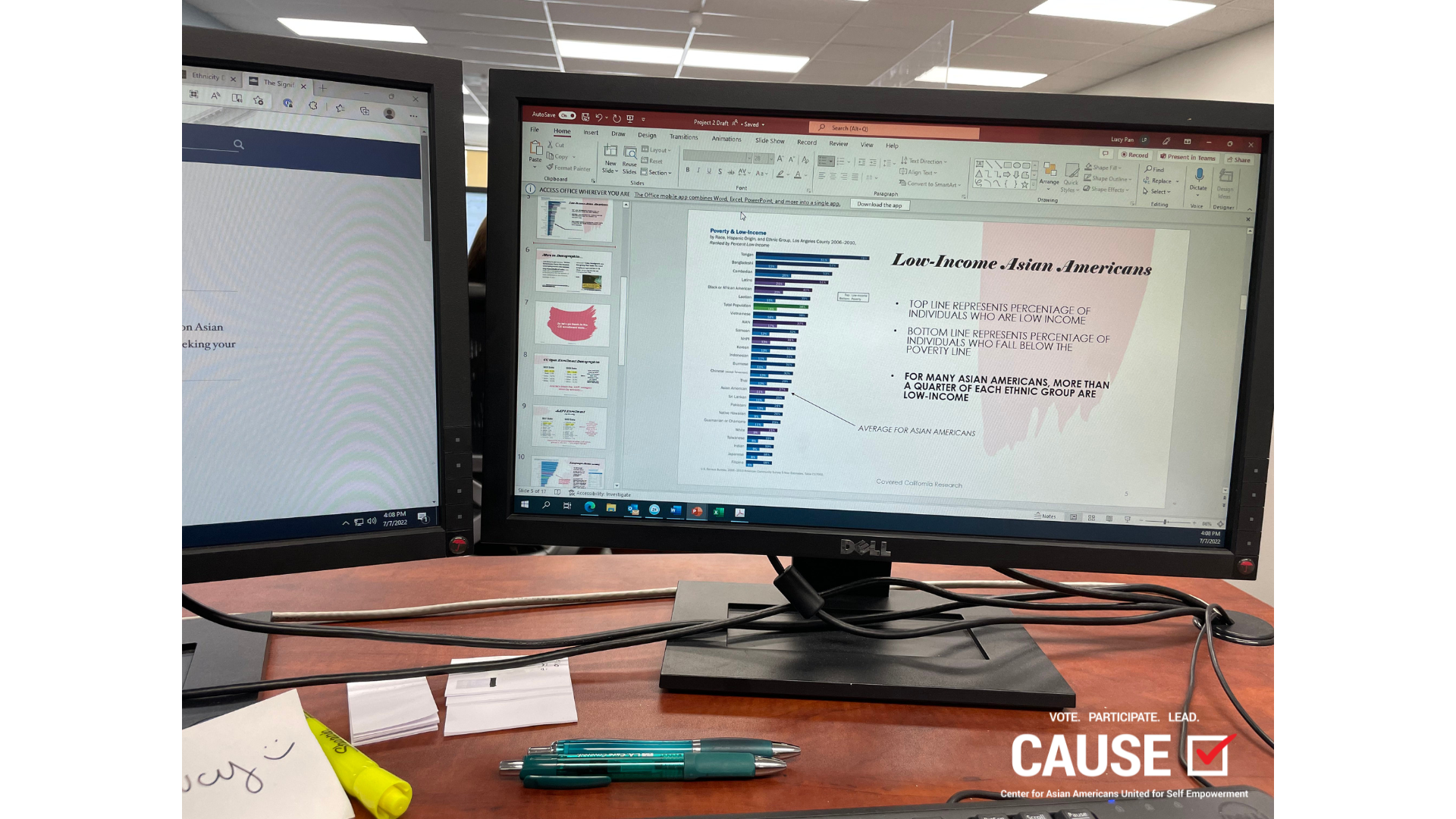

My first project involved doing demographic research on Asian American seniors in California and across the West Coast, looking at which healthcare resources are currently available to them and how their needs can be better met. In doing so, I stumbled upon lots of disaggregated data from Asian Americans Advancing Justice, which painted clear pictures of the different AAPI communities in LA County, especially in the San Gabriel Valley. I appreciated the meticulousness with which the data was sorted into categories such as immigration, per capita income, education, insured/uninsured, homeowner/renter, etc. One challenge I’ve consistently faced is finding disaggregated data regarding the AAPI community, so the resources from Advancing Justice were not only helpful for the project, but also have significantly helped me become more informed about the needs of different AAPI groups in Southern California.

One topic I felt particularly drawn to was the lack of language resources and translation services, which is crucial when trying to enroll in health insurance. This week, Barbara and I met with Amy, an insurance agent who works directly with clients, to talk about common issues that folks might face when trying to navigate getting health insurance. Amy mentioned that one large issue is the lack of adequate language resources, as a lot of their clients struggle with English, yet insurance companies don’t often provide the translation services necessary for clients to fully understand the ins and outs of their insurance plans. Another issue she brought up was transportation, as a lot of seniors lack the means to get to a doctor’s office or to the hospital on their own, and transportation is often not covered within insurance plans. This was something that had not crossed my mind before, and I’m grateful to have been able to meet with people in KCal who are teaching me more about healthcare accessibility. Next week, I’ll have the opportunity to shadow Amy as she interacts with clients, which I’m very much looking forward to!